In the digital age, sending money across borders has become more accessible and convenient than ever before. Whether you’re supporting family members, conducting business transactions, or sending funds for any other reason, choosing the right platform for your money transfers is crucial. When it comes to sending money to Pakistan, numerous apps offer varying features, fees, and exchange rates. In this article, we’ll explore some of the best options available, considering factors such as security, affordability, user experience, and additional features.

Table of Contents

Introduction: Why Choosing the Right App Matters

Sending money to Pakistan involves more than just initiating a transaction. It’s about ensuring the safety and security of your funds, obtaining the best exchange rates, and experiencing a smooth and hassle-free process. With the multitude of money transfer apps available today, finding the one that aligns with your needs and preferences can make a significant difference in your overall remittance experience.

How to choose the best app to send money to Pakistan:

When it comes to choosing the best app for money transfer to Pakistan, several factors must be considered.

1. Security Features

Security is paramount when dealing with financial transactions. Look for apps that offer robust encryption and authentication methods to safeguard your sensitive information and funds.

2. Transfer Fees

Different apps may have varying fee structures. Some charge a flat fee per transaction, while others may take a percentage of the transferred amount. Consider your transfer frequency and amount to find the most cost-effective option.

3. Exchange Rates

Exchange rates play a significant role in determining the value of your transferred money. Compare rates offered by different apps to ensure you get the best deal without losing much to unfavorable exchange rates.

6 best apps to send money to Pakistan:

There are quite a few options you can consider when you are looking to send money to Pakistan, here are top 6 recommendations based on our research.

1. XE Money Transfer

XE Money Transfer stands out as one of the top choices for sending money to Pakistan. It offers competitive exchange rates and low fees, making it cost-effective for users. With XE Money Transfer, you can easily send money directly to Pakistani bank accounts or opt for cash pickup options.

- Global Currency Exchange Platform: XE is a renowned global currency exchange platform trusted by millions worldwide. It offers a seamless and secure way to send money to Pakistan, ensuring reliability and peace of mind for users.

- Competitive Exchange Rates: XE provides competitive exchange rates, allowing users to maximize the value of their transfers. This ensures that recipients in Pakistan receive more funds in their local currency.

- Transparent Fees: XE Money Transfer maintains transparency regarding its fees, ensuring that users are aware of any charges associated with their transactions upfront. This transparency builds trust and confidence among users.

- Fast and Efficient: XE Money Transfer offers quick and efficient transfer services, allowing users to send money to Pakistan promptly. Whether it’s for urgent family support or business transactions, XE ensures timely delivery of funds.

- User-Friendly Interface: The XE Money Transfer app features a user-friendly interface that makes the sending process intuitive and straightforward. Users can easily navigate through the app to initiate transfers with ease.

2. WorldRemit

WorldRemit is another excellent option for sending money to Pakistan. It provides various transfer methods, including bank deposits, cash pickups, and mobile wallet transfers, such as Upaisa, JazzCash, and Easypaisa. WorldRemit is known for its convenience, speed, and reliability.

- Versatile Transfer Options: WorldRemit offers multiple transfer methods, including bank transfers, cash pickups, and mobile wallet transfers like Upaisa, JazzCash, and Easypaisa. This flexibility allows users to choose the most convenient option for themselves and their recipients.

- Convenience: With WorldRemit’s user-friendly mobile app, sending money to Pakistan is quick and easy. Users can initiate transfers anytime, anywhere, providing ultimate convenience.

- Fast and Secure: WorldRemit ensures fast and secure transactions to Pakistan. Whether it’s for emergency funds or regular remittances, users can rely on WorldRemit for swift and safe money transfers.

- Competitive Rates: WorldRemit offers competitive exchange rates, maximizing the value of each transfer. Users can rest assured that their recipients in Pakistan will receive the most favorable conversion rates.

- Trackable Transfers: Through the WorldRemit app, users can easily track their transfers in real-time. This feature provides peace of mind and transparency throughout the transfer process.

3. Western Union

Western Union has long been a trusted name in the money transfer industry. With its global network of agent locations and online platform, you can easily send money to Pakistan from virtually anywhere. Western Union offers multiple delivery options, including bank deposits and cash pickups.

- Global Network: With Western Union’s extensive network, users can send money to Pakistan from almost anywhere in the world. Whether sending from the US, UK, or elsewhere, Western Union provides reliable international money transfer services.

- Convenient Mobile App: The Western Union mobile app offers a user-friendly interface, making it convenient to initiate transfers, track transactions, review exchange rates, and locate agent locations directly from a smartphone.

- Trusted Reputation: Western Union has a long-standing reputation for safety and reliability in money transfers. Users can trust Western Union’s secure platform to deliver funds promptly and securely to recipients in Pakistan.

- Multiple Transfer Options: Western Union offers various transfer options, including bank transfers and cash pickups, providing flexibility for both senders and recipients in Pakistan .

- Competitive Exchange Rates: Western Union strives to offer competitive exchange rates, ensuring that users get the best value for their money when sending funds to Pakistan

4. Remitly

Remitly is a user-friendly online money transfer service that offers safe and low-cost transfers to Pakistan. It provides transparent exchange rates and allows you to track your transfer every step of the way. Remitly also offers various delivery options to suit your recipient’s preferences.

- Trusted Service: Remitly has been serving customers since 2011 and is trusted by millions worldwide.

- Convenient: The Remitly app allows users to send money quickly and securely to banks and over 460,000 cash pickup locations in Pakistan.

- Transparent Fees: Users can enjoy consistently great rates and see all fees upfront before sending money, ensuring transparency.

- Fast Delivery: Remitly offers fast delivery options, including bank transfers and cash pickup, ensuring that funds reach recipients promptly.

- Positive Reviews: The service receives positive reviews for its ease of use, reliability, and low fees

5. Xoom

Xoom, a PayPal service, is widely recognized for its fast and secure money transfer services. With competitive exchange rates and low transfer fees, Xoom offers a convenient way to send money to Pakistan from anywhere in the world. The platform supports various payment methods, including bank transfers, debit cards, and credit cards, making it accessible to a wide range of users.

- Fast and Easy: Xoom offers a fast and easy way to send money to Pakistan, with quick deposits to Pakistani rupee accounts.

- User-Friendly App: The Xoom Money Transfer app provides a seamless experience for users, ensuring convenience and ease of use.

- Global Coverage: With Xoom, users can send money to a bank account, for cash collection, or to top up airtime, covering various needs of recipients in Pakistan.

- Reliable Service: Xoom is known for its reliability and responsiveness, providing customers with peace of mind when sending money internationally.

- Transparent Fees: While fees may vary, Xoom offers transparent pricing, allowing users to know the costs upfront before initiating a transfer.

6. TransferWise or wise

TransferWise, now known as Wise, stands out for its transparent fee structure and mid-market exchange rates. With TransferWise, you can send money to Pakistan with minimal fees and maximum transparency, ensuring that your recipient receives the full amount without any hidden charges. The platform’s intuitive interface and straightforward process make it a preferred choice for users seeking simplicity and value in their money transfers.

- Competitive Exchange Rates: TransferWise offers competitive exchange rates when transferring money to Pakistan, ensuring that your recipients receive a fair amount in Pakistani Rupees.

- Transparent Fees: With TransferWise, you know exactly how much you’re paying in fees upfront, ensuring transparency and no hidden costs.

- Convenience: TransferWise provides various payment options, including Google Pay, Apple Pay, debit card, credit card, and bank transfer, making it convenient for users to send money to Pakistan.

- Wide Currency Support: TransferWise supports transfers from multiple currencies to Pakistani Rupees, giving users flexibility in choosing their preferred currency for sending money.

- Trusted Service: TransferWise is a reputable and trusted platform for international money transfers, known for its reliability and security.

Choosing the best app to send money to Pakistan depends on factors such as transfer fees, exchange rates, delivery options, and overall convenience. By considering these factors and exploring the options mentioned above, you can find the right app that meets your needs for sending money to Pakistan reliably and efficiently.

Additional Things to consider:

User Experience: Simplicity and Speed

In addition to security and affordability, user experience plays a crucial role in determining the best app for sending money to Pakistan. Choose a platform that offers a seamless and intuitive interface, allowing you to initiate and track your transfers with ease. Look for apps that prioritize speed and efficiency, ensuring that your funds reach the recipient in a timely manner.

Customer Support: Accessibility and Reliability

In the event of any issues or inquiries, responsive customer support can make a world of difference. Opt for apps that offer multiple channels for support, such as live chat, email, and phone support, and ensure that assistance is available whenever you need it. Reliable customer support adds an extra layer of confidence and peace of mind to your money transfer experience.

Additional Features: Value-Added Benefits

Beyond the basic transfer functionalities, some apps offer additional features and perks that enhance the overall remittance experience. Look for apps that provide integration with other financial services, loyalty programs, and referral bonuses, adding value and convenience to your transactions.

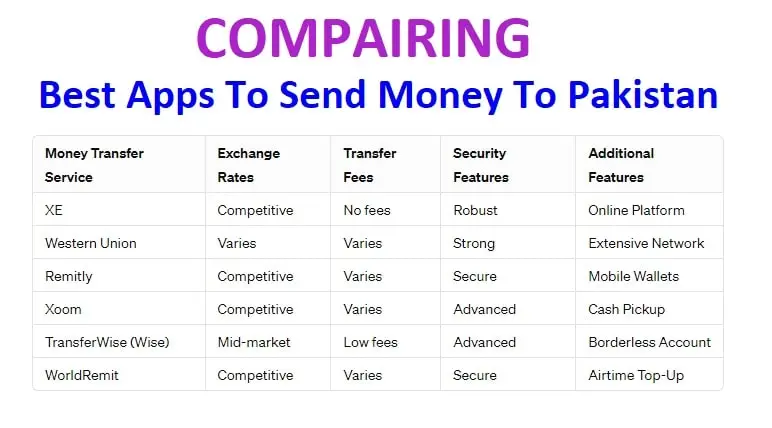

Comparing Table for Best apps to send money to Pakistan:

Here is the comparison Table for best apps to send money to Pakistan based on Security Features, Transfer fees and exchange rates.

Wrapping up:

- XE Money Transfer

- Offers competitive exchange rates and low fees.

- Trusted global currency exchange platform.

- Transparent fee structure and efficient transfer services.

- Allows transfers directly to Pakistani bank accounts or cash pickups.

- WorldRemit

- Provides versatile transfer options, including bank deposits and cash pickups.

- Convenient and user-friendly mobile app.

- Ensures fast and secure transactions with competitive exchange rates.

- Offers real-time tracking of transfers for transparency.

- Western Union

- Boasts a global network for reliable international money transfers.

- Convenient mobile app for easy transactions and tracking.

- Long-standing reputation for safety and reliability.

- Multiple transfer options, including bank transfers and cash pickups.

- Remitly

- Trusted service with positive reviews for ease of use and reliability.

- Offers fast delivery options to banks and cash pickup locations.

- Transparent fee structure with upfront fees and competitive rates.

- Ensures secure and efficient transactions for peace of mind.

- Xoom

- Provides fast and easy money transfers with a user-friendly app.

- Global coverage for transfers to Pakistani bank accounts and cash pickups.

- Reliable service known for its responsiveness and security.

- Transparent pricing with upfront fees and competitive exchange rates.

- TransferWise (Wise)

- Offers competitive exchange rates and transparent fees.

- Convenient payment options, including Google Pay and Apple Pay.

- Wide currency support for flexibility in transfers to Pakistan.

- Reputable platform known for reliability and security.

People Also Asked For:

how long does xe money transfer money?

Xe Money Transfer typically takes 1 to 4 business days for the transfer to reach the recipient’s account

how safe is xe money transfer?

XE Money Transfer is considered safe to use. It is a trusted and fully regulated platform, ensuring security and reliability for its users.

how to receive money from worlmit?

To receive money from WorldRemit, follow these steps:

Create an Account: Sign up on WorldRemit’s website or app.

Select Receive Method: Choose between wallet transfers or cash pickup.

Provide Details: Ensure your sender has your necessary information.

Access Your Money: Once the transfer is initiated, follow instructions to access funds.

does western union cash checks?

No, Western Union does not cash personal checks. They facilitate money transfers via cash, ATM, or credit card, but they do not provide check cashing services.

how much western union charge to send money from pakistan to uk?

The fees charged by Western Union to send money from Pakistan to the UK vary based on factors such as the amount being sent, the payment method, and the transfer speed.

which bank have western union in Pakistan?

Several banks in Pakistan offer Western Union services, including:

AL Baraka Islamic Bank Limited

Allied Bank Limited

Apna Micro Finance Bank

Askari Bank

Ravi Exchange Company

Paragon Exchange Company

NBP Exchange

how long does remitly take to send money to Pakistan?

Remitly offers two speed options for sending money to Pakistan:

Express: The transfer is sent within minutes, but it may take longer to deliver depending on the chosen delivery option. This option is usually associated with a higher fee.

Economy: The transfer typically takes 3 to 5 business days for delivery to the recipient in Pakistan.

Disclaimer: The numbers associated with each app are not indicative of their ranking. Rather, they serve as identifiers for easier reference within this article. The selection of the best app ultimately depends on your individual preferences, requirements, and priorities.